From the second quarter of 2022, major MLCC manufacturers began to reduce production, and the high inventory of MLCC has had some “slimming” effect, but this supply-side adjustment has not had a significant effect on pulling the overall demand.

In the first quarter of 2023, Samsung Electric saw its sales fall by 595 billion won (23%) and its operating profit drop by 270.4 billion won (66%) compared to the same period last year. The growth of high value-added MLCC supply and vehicle MLCC sales could not offset the continued weak demand for IT equipment such as PCS due to the global economic downturn.

TAIYO YUDEN’s net sales for the fiscal year ended March 31, 2023, as well as operating profit, ordinary profit and profit attributable to the owner of the parent company, all decreased due to lock-downs in some regions as well as reduced production volumes and inventory adjustments, primarily in the PC, smartphone and data center segments.

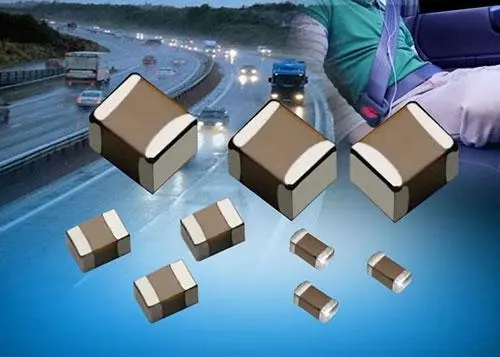

Unable to save the depressed market MLCC giants, obviously more confident in the car, Samsung Electric this year to pay attention to the market response of high-end MLCC, as well as AI and automated robots growth breakthrough, relying on automotive MLCC continued to solid performance.

New demand such as automotive electronics has become a “stability” agent for the performance of large factories, and consumer electronics, which accounts for the largest proportion, can usher in real demand from the consumer side and drive the overall MLCC recovery, let us wait and see.

Post time: Sep-12-2023